1. Introduction to Forex Trading in Iceland

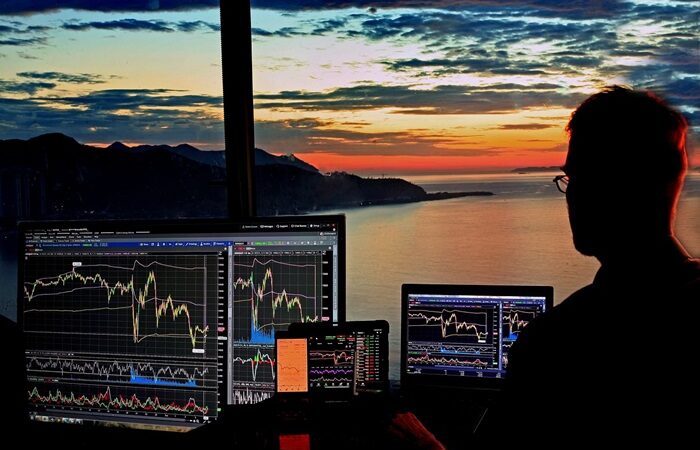

Forex trading, the exchange of currencies in the global market, has gained popularity in Iceland in recent years. Despite its relatively small economy, Iceland’s participation in forex trading has been notable due to various factors such as technological advancements, accessibility, and economic dynamics.

2. Opportunities for Forex Traders in Iceland

- Technological Advancements: The availability of online trading platforms has made forex trading accessible to individuals in Iceland, allowing them to participate in the global financial markets from anywhere with an internet connection.

- Market Liquidity: The forex market operates 24 hours a day, five days a week, providing ample liquidity for traders in Iceland to enter and exit positions without significant price fluctuations.

- Diverse Currency Pairs: Forex trading offers a wide range of currency pairs, allowing traders in Iceland to diversify their portfolios and explore various trading strategies.

- Potential for Profit: With proper education, analysis, and risk management, forex trading can offer significant profit opportunities for traders in Iceland, regardless of their level of experience.

3. Challenges Faced by Forex Traders in Iceland

- Currency Volatility: The Icelandic króna (ISK) is known for its volatility, which can pose challenges for forex traders. Sudden fluctuations in the value of the króna may impact trading decisions and require robust risk management strategies.

- Regulatory Environment: While forex trading is legal in Iceland, traders must navigate a regulatory framework that ensures consumer protection and market integrity. Understanding and complying with these regulations is essential for traders operating in Iceland.

- Limited Domestic Brokerage Options: Iceland has a relatively small financial industry, leading to limited options for domestic brokerage firms. As a result, traders may need to rely on international brokers, which can present additional challenges such as language barriers and currency conversion fees.

- Geopolitical Influences: Iceland’s economy is influenced by various geopolitical factors, including its dependence on foreign trade and investment. Geopolitical events and developments can impact currency values, requiring traders to stay informed and adapt their strategies accordingly.

- Market Risks: Like any financial market, forex trading carries inherent risks, including market volatility, economic uncertainty, and geopolitical tensions. Traders in Iceland must be prepared to manage these risks effectively.

4. Strategies for Success in Forex Trading

- Education and Research: Continuous learning and staying informed about market trends, economic indicators, and geopolitical events are crucial for success in forex trading.

- Risk Management: Implementing effective risk management strategies, such as setting stop-loss orders and proper position sizing, can help mitigate potential losses and protect capital.

- Adaptability: Being adaptable and flexible in response to changing market conditions is essential for navigating the dynamic forex market effectively.

- Discipline and Patience: Maintaining discipline and exercising patience are key attributes of successful forex traders. Emotions such as greed and fear can cloud judgment and lead to poor trading decisions.

- Diversification: Diversifying trading strategies and currency pairs can help spread risk and enhance overall portfolio performance.

5. Conclusion: The Future of Forex Trading in Iceland

Forex trading in Iceland offers both opportunities and challenges for investors seeking to participate in the global currency markets. With the right approach, education, and risk management, traders in Iceland can potentially capitalize on the opportunities presented by forex trading while navigating its inherent challenges. As technology continues to evolve and market dynamics shift, the future of forex trading in Iceland holds promise for those willing to adapt and seize opportunities in this dynamic market.

Anasayfa

Anasayfa Canlı Borsa

Canlı Borsa Borsa

Borsa Döviz Kurları

Döviz Kurları Altın

Altın Hisse Senetleri

Hisse Senetleri Endeksler

Endeksler Döviz Hesaplama

Döviz Hesaplama Döviz Çevirici

Döviz Çevirici Kredi Arama

Kredi Arama